SBA released the official form to fill out for applying forgiveness on PPP Loan. Now that lenders are opening up for forgiveness applications. It is time to start prepare the documents need to qualify for full foreignness.

There are some documents and information requirements are universal to prove if you used the PPP Loan to cover any of following.

– Payroll costs

To prove payroll costs, you need to prepare:

- Payroll service reports documenting wages and salaries paid to employees

- Federal payroll tax filing (IRS Form 941 / 943)

- State quarterly Payroll, Income, and Unemployment insurance reports

- Receipts* for employee contributions to employee benefits

- Receipts* for any retirement plan contributions

– Owner compensation

To prove owner compensation payments, you need t prepare:

- 2019 Schedule C (or January to February 2020) for Sole Proprietorships

- 2019 Form 1099-MISC (or January to February 2020) for Independent Contractors

- 2019 Schedule K-1 (or January to February 2020) for Partnerships

- Receipts for compensation payment

If there is more than one individual included, provide a separate document that lists the names and payments to each owner.

– Mortgage interest payments

To prove mortgage interest payments, you need to prepare:

- Mortgage amortization schedule or mortgage account statements

- Receipts or cleared checks

– Rent/ Lease payments

To provide rent/ lease payments, you need to prepare:

- Current Lease agreement and receipts or cleared checks

- Lender monthly account statements

– Utilities payments

To prove utilities payments, you need to prepare:

- Monthly utilities statements or involves

- Receipts, cleared checks, or account statements

*Payment receipts, cleared checks, or account statements documenting the amount that the Borrower included in the forgiveness

What is next?

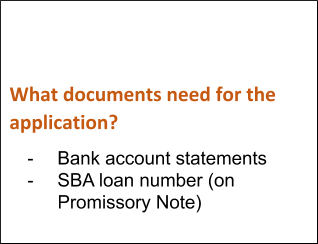

Once you have prepared all documentations, it is time to fill out the application form and upload supplemental documents into your portal.