First, what is a bank reconciliation?

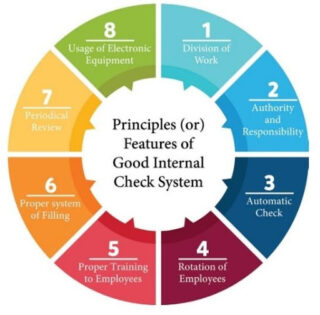

When you reconcile your bank account or statement, you compare your internal financial records such as bookkeeping records against the records provided by financial institutions. A monthly reconciliation helps your business to detect discrepancies and errors as well as identify any unusual transactions that might be caused by fraud actions. In other word, this practice can help your business inefficiencies in accounting procedures.

How often to reconcile bank statements?

How often to reconcile bank statements?

Many business performs monthly bank reconciliation for identifying problems. It is the best to have a regular schedule and save bank statement or other related document for avoiding time-consuming task. Some businesses with a lot of transactions, reconcile on a daily basis. If something does not match with your record against bank statement, it might be due to timing differences that items or checks have not yet cleared. However, bookkeepers and accountants should be able to explain those differences.

Once you have figured out the reasons why bank statement and records do not match up, you need to record them by making adjusting journal entries.

Best Bank Reconciliation Practice and Tips

To reconcile bank accounts, you need to compare your internal record of transactions, balances, and descriptions to your monthly bank statement. Make sure matching the amounts and stating any memo or note for differences that requires more investigation and detail.