Why is it important to have strong internal control within an organization?

A control environment is made up of a compilation of an entity’s organizational structures, policies, standards, and processes that maintain control across the organization. Having effective control environments with adequate internal control is essential for businesses to reduce the risk of asset loss and ensure reasonable assurance for stakeholders and businesses. Moreover, implementing a strong internal control, businesses establish solid protocols and procedures for their employees and partners. It allows businesses to prevent fraud and theft by separation of duties and organization of financial and management information.

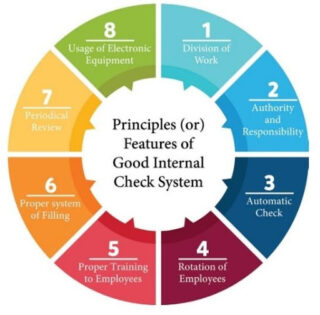

Here are some best practices that should mitigate issues from happening in your business.

- Segregation of Duties

- Physical Controls

- IT Controls

- Accounting Standards and Policies

- Ethical Learnings

We strongly recommend to educate and train your employees for prevention of fraud as well as errors and mistakes.